Exploring Top Dividend Stocks In France For March 2024

Amidst a backdrop of fluctuating global markets, with the Federal Reserve holding interest rates steady and sectors showing varied performance, investors are keenly observing market trends for stable investment opportunities. In this context, dividend stocks in France present an appealing option for those looking to navigate the current economic landscape thoughtfully.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Samse (ENXTPA:SAMS) | 8.36% | ★★★★★★ |

Rubis (ENXTPA:RUI) | 6.95% | ★★★★★★ |

Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 7.72% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.52% | ★★★★★★ |

Métropole Télévision (ENXTPA:MMT) | 9.44% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.29% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 4.46% | ★★★★★☆ |

TotalEnergies (ENXTPA:TTE) | 4.90% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 3.76% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.78% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

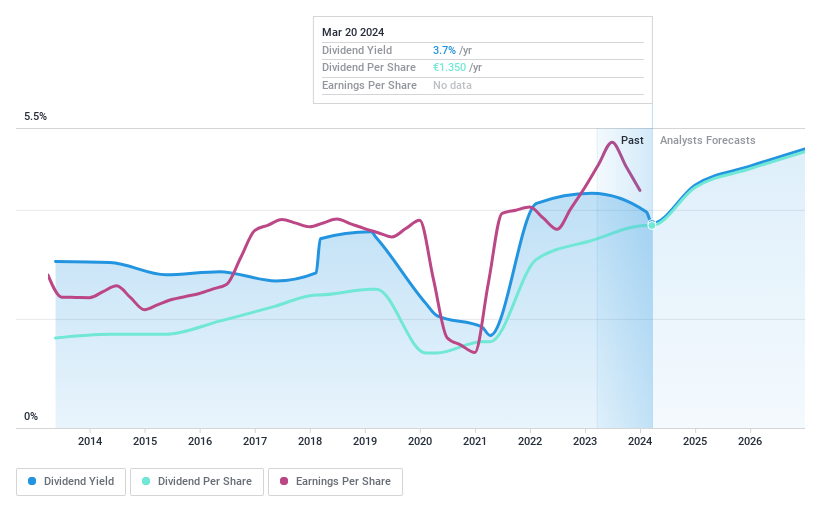

Compagnie Générale des Établissements Michelin Société en commandite par actions (ENXTPA:ML)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Compagnie Générale des Établissements Michelin Société en commandite par actions is a global manufacturer and seller of tires, with a market capitalization of €25.75 billion.

Operations: Michelin's revenue is generated from three primary segments: Automotive and Related Distribution (€14.34 billion), Road Transportation and Related Distribution (€6.98 billion), and Specialty Businesses and Related Distribution (€7.03 billion).

Dividend Yield: 3.7%

Michelin, with a payout ratio of 48.7% and cash payout ratio of 32%, demonstrates a capacity to cover dividends through earnings and cash flows, suggesting sustainability. However, its dividend yield at 3.75% is below the French market's top quartile at 5.78%, reflecting less attractiveness for yield-seeking investors. The company's dividend history shows volatility and unreliability over the past decade, despite an overall increase in payments. Recent actions include announcing a €1 billion share repurchase program valid until 2026, indicating potential confidence in financial health despite slight dips in sales and net income reported for the year ended December 31, 2023.

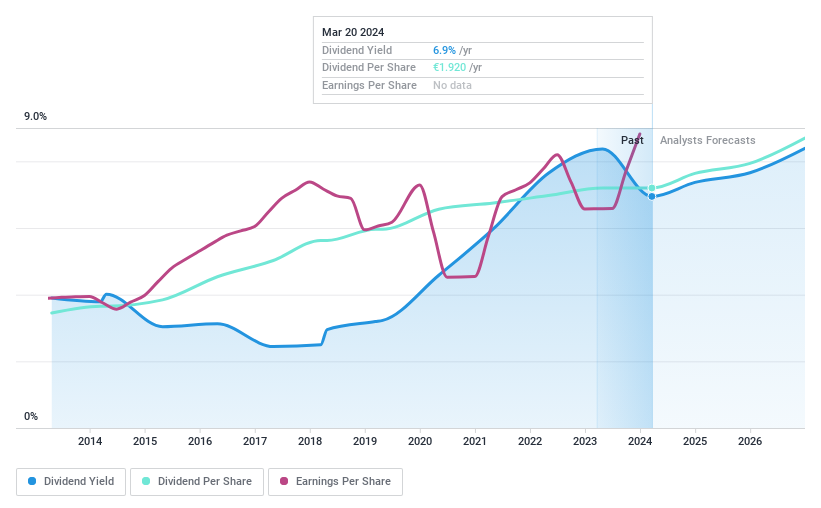

Rubis (ENXTPA:RUI)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Rubis operates bulk liquid storage facilities for commercial and industrial customers across Europe, Africa, and the Caribbean, with a market capitalization of €2.85 billion.

Operations: Rubis generates its revenue primarily through energy distribution, amounting to €6.58 billion, and renewable electricity production, contributing €48.64 million.

Dividend Yield: 6.9%

Rubis reported a net income increase to €353.69 million from last year and proposed a dividend per share increase to €1.98 for fiscal year 2023, reflecting a commitment to shareholder returns despite a slight decrease in sales from the previous year. The company's payout ratio stands at 75%, indicating dividends are well-covered by earnings, with sustainability supported by both earnings and cash flow coverage ratios. Recent executive appointments and strategic focus on bolt-on acquisitions within existing geographies demonstrate an ongoing effort to bolster business and shareholder value, underpinning its dividend attractiveness amidst high debt levels.

Navigate through the intricacies of Rubis with our comprehensive dividend report here.

Upon reviewing our latest valuation report, Rubis' share price might be too pessimistic.

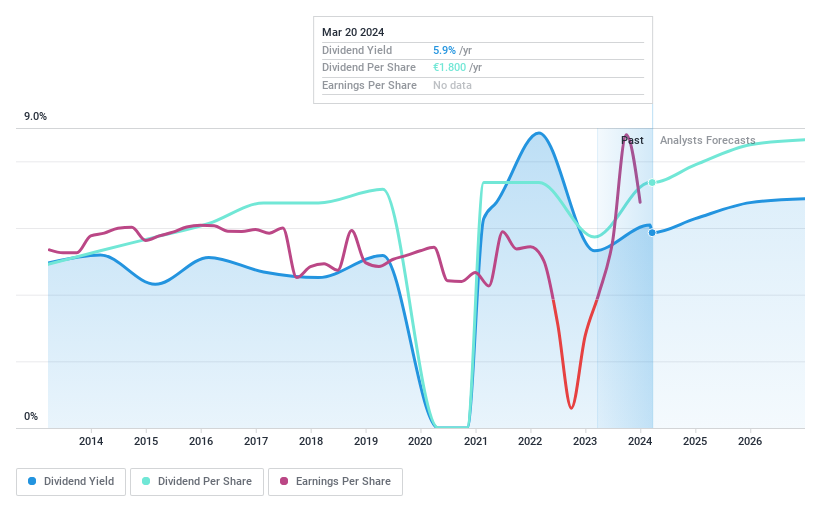

SCOR (ENXTPA:SCR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SCOR SE operates globally, offering both life and non-life reinsurance products across continents including Europe, the Middle East, Africa, the Americas, Latin America, and Asia Pacific, with a market capitalization of €5.51 billion.

Operations: SCOR SE generates its revenue primarily through life reinsurance (SCOR L&H) with €7.07 billion and property and casualty reinsurance (SCOR P&C) contributing €5.64 billion.

Dividend Yield: 5.9%

SCOR SE transitioned from a net loss of €1.38 billion to a net income of €812 million in 2023, showcasing significant financial recovery. The company's dividend yield stands at 5.86%, placing it among the top French dividend payers, supported by a conservative payout ratio of 39.7% and a cash payout ratio of 22.3%, indicating strong coverage by both earnings and cash flows despite its historically unstable dividend track record. Additionally, SCOR's collaboration on the Techficient Dynamic Platform for AIMCOR QuickLife introduces innovative digital insurance solutions, potentially enhancing its market position and investor appeal without compromising its attractive valuation, trading significantly below estimated fair value.

Unlock comprehensive insights into our analysis of SCOR stock in this dividend report.

Our valuation report here indicates SCOR may be undervalued.

Seize The Opportunity

Click through to start exploring the rest of the 30 Top Dividend Stocks now.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com